The luxury industry is built today on a geographical paradox: “The brands are from Europe but the market is in Asia!”

Shanghai Tang, a local luxury brand from China

In China, there is Xinyu Hengdeli, which is a listed company. Groups like Swatch and LVMH have taken stakes in these companies. Shanghai Tang, a luxury brand for tourists seeking high-end Chinese products has been acquired by Richemont Group. Hermès launched Shang Xia, a local luxury brand in China, with its first boutique in Shanghai. It is surprising, to say the least, considering it is the first time in its history that Hermès has created a brand that will incur revenues from products made in China. In 2013, the first Shang Xia store opened in Paris. This way, the brand will have the “sold in Paris” associated to its reputation.

Exclusivity, limited production and high quality manufacturing in France have been part of its DNA since the brand was set up. Unlike Louis Vuitton or Gucci, Hermès has had, strategically, a much slower rhythm of expansion in order to preserve exclusivity and maintain its position as a true luxury brand. As it chose not to open tens of stores and or increase production, moves that could damage the reputation of the brand, Hermès decided to launch a brand for the Chinese market. However, Hermès maintains that the move was motivated primarily by the wealth of the Chinese culture and its manufacturing tradition.

Chanel has launched specific collections with the Chinese consumer in mind. The latest look is a long, slim dress in a rich, opulent fabric, slit to the thigh on each side to offer a glimpse of a contrast lining. That this style borrows from the traditional Chinese cheongsam is probably not a coincidence. With haute couture fighting for its life, a battle is being waged between the elite houses of Paris for the hearts, minds and wallets of the wealthy Chinese clients who are stepping into the gap left by dwindling American orders. For example, the “take away” purse was the highlight of the collection, making for an unusual spin on the classic Chanel chain bag. There was also a khaki clutch, earring shaped as Chinese dolls, and a vintage looking bracelet featuring dragons. In a way, luxury brands are moving from a phenomenon of “Made in China” to “Made for China”.

Shang Xia launched by Hermes

According to Jiang Qiong Er, CEO and Creative Director, SHANG XIA, the Chinese homegrown luxury brands that had a presence a century ago, withdrew in the early 90s as the Western ones took over. However, Jian observed that gradually attitudes started changing as consumers stopped shunning all things Chinese, recognizing a need to reconnect with their own cultural backgrounds and becoming more curious about their heritage. “I think more people in China realize the importance of looking back to our cultural roots, going back and trying to re-evaluate the value of Chinese culture,” Jiang says in an interview to Jing Daily. “More people here are starting to realize that, in our lives today, we’re dominated by Western lifestyles. But if you look back at the history of the world, you’ve got both Western and Eastern cultures. At one time, Eastern culture was at the peak, but that flipped. So maybe it’s time to flip it around again in some way.”

In a sense, we see some companies follow a global strategy, like Chanel, and other companies operate more of a multi-national strategy like Hermès, in their pursuit to entrench themselves in the Chinese markets. Which model will succeed? What will be the bottlenecks? Will the markets evolve in an anticipated and expected pattern or will it change in an unpredictable way, wherein new strategies need to be devised for future growth.

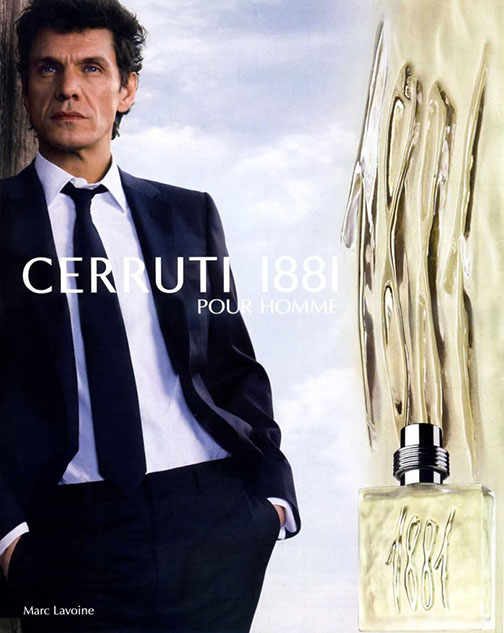

Italy’s Cerruti is now controlled by China’s Trinity Limited

To conclude

In this scenario, within a volatile, uncertain, complex and ambiguous emerging market environment, luxury companies need to balance the demand and supply volatility, cost and value propositions, global design and local trends, and foreign exchange fluctuations. Coupled with this, Asia’s emerging markets are not only diverse but are also at widely different stages of development. To manage these continuous disruptions won’t be easy. Reports from E&Y in 2013 and by UBS in 2012, 50% of the world luxury revenue comes from Asia.

Over half of the consumption of European luxury goods is from the tourists from Asian countries. In the past décade, a flurry of French, English and Italian luxury brands have ceded control to foreign investors, some still suffering a hangover of 2008s global financial crisis, others in a bid to expand and better conquer ’emerging’ markets.

Britain’s Aquascutum was acquired by China’s YGM, Italy’s Cerruti is now controlled by China’s Trinity Limited, Germany’s Escada is owned by India’s Mittal family, and France’s Sonia Rykiel forms a part of Hong Kong based Fung Brands. Bedat, Gieves & Hawkes, ST Dupont, Ferretti Group and Pringle of Scotland form further examples of European brands picked up by foreign owners. Way back in 2001, Taiwanese entrepreneur Shaw-Lan Wang purchased France’s oldest couture house, Lanvin. A label she returned to profitability in 2007, under the creative direction of Alber Elbaz. Most recently Kazakh billionaire Goga Ashkenazi bought a majority stake in fashion house Vionnet. This trend is not a surprise as the region covering China, South East Asia and Japan now has more centa-millionaires (over $100m in assets) than US or Europe.

Britain’s Aquascutum was acquired by China’s YGM

The implications for luxury brand owners from Europe and Asia, wanting to succeed in Asia, creates both challenges and opportunities. The challenges they face are as follows:

- Understand the evolving definition of luxury: what is luxury today might not be luxury tomorrow for specific consumers.

- Understand a dynamic and very different, knowledgeable and agile consumer segment who might demand complementary luxury consumption that transcends both oriental and occidental culture.

- Disrupt and differentiate between high margin versus high volume consumers for local relevance, and a granular understanding of current and future profit markets.

- Affordable luxury and lifestyle luxury is breaking new ground in Western Europe and North America.

- Luxury spending in China may witness fluctuations due to government clampdown on extravagant consumption.

Taiwanese entrepreneur Shaw-Lan Wang purchased France’s oldest couture house, Lanvin

The opportunities they face are as follows:

- Local adaptation might lend credibility and respect for the region but not at the cost of the brands DNA.

- Emerging market consumers are more often brand, status or price conscious rather than value, quality and experience conscious.

- In addition to the five senses, luxury must incorporate market specificities of design environment, surroundings, connections, networks that provides freedom, bespoke/unique experiences to consumers that are specific to regions.

- In Asia, it is more important to know ‘who’ buys rather than ‘where’ a product is sold, a knowledge that may lead to a network for future consumption.

- Traditionally ‘luxury’ brands are ‘European’ and enjoy country-of-origin effect but as the ‘Asian’ brands will evolve there may be a shift to the status of ‘global’ brands.

Footnotes

For example, spending in emerging markets is projected to increase by more than 35 percent over the next five years. According to reports, India was the most dynamic luxury market over the 2008 to 2013 period and is forecast to grow by a further 86 percent in constant value terms over the five years to 2018, followed by China at 72 percent.