After almost a year-long break, Luxury Next is back, we are hoping more knowledgeable and in a better position to represent, through our blogs, the state of the luxury industry across the world.

To start off, we analyse the biggest trends that will change the face of the luxury industry – from the establishment of extravagant retail flagships to the rise of wearable tech.

The luxury industry, like most world economies, is going through uncertain times. The growing aspirational middle class isn’t buying luxury as it was expected to; China and Russia both are showing signs of slowing down. The elite, at least the ones from India, prefer to buy their luxury abroad because it’s cheaper, rather than in the country because of high taxes.

Despite the slowdown, there are a few luxury trends that are discernible and will hopefully pay off in the near future.

Sabyasachi Flagship Store

1. The rise of the flagship store: While everyone is discussing the real possibilities offered by e-commerce, luxury, interestingly, is taking the retail experience offline. The presence of gorgeous flagship stores has begun paying huge dividends. In India, Sabyasachi Mukherjee, Tarun Tahiliani and Gaurav Gupta have set up stunning flagship stores in Mumbai and Delhi. Their flagships are more art galleries and museums then a retail store. Gupta’s stores have surrealistic sculptural installations that are as avant-garde as his clothes. Mukherjee takes us to India’s glorious past through his stores: vintage clocks, old paintings, clusters of old-world lights, rugs, printed wallpapers, gramophones, old, rare books, in a museum-like sensual space encourages you to stand and stare. Tahiliani’s sea-fronted Mumbai store is a beautiful canvas for Kashmir woodwork and antique accessories. Indian jewellery czar Nirav Modi has opened an expansive, all-pink flagship store in New York. In the west, Peter Marino, a New York-based architect, has designed dozens of flagships for LVMH and Chanel, the French luxury groups. He believes that customers from China, Russia and India, the new consumers of luxury, enjoy the experience of shopping in an extravagant retail outlet. Coach has announced it would open a snazzy new flagship store on Manhattan’s Fifth Avenue. They aren’t alone on the strip, considered the most expensive shopping strip in the world: it is home to brands like Rolex, Ermenegildo Zegna, and Salvatore Ferragamo.

Apple Watch and Hermes (Courtesy Apple Inc.)

2. Wearable Tech: Everyone dismissed wearable technology as a non-luxury segment. So, they were left stunned when Apple Watch was launched for a princely sum of £20,000. It came encased in an 18 karat gold pink case. It is a known fact that the best technology is expensive and targets the world’s wealthiest people. While the technology is similar to a lower cost product, it is the bells and whistles that elevate a tech product to the realm of luxury: the feel, look and the design. And wearable tech like smart watches, are tapping this market for expensive, beautiful designed tech products.

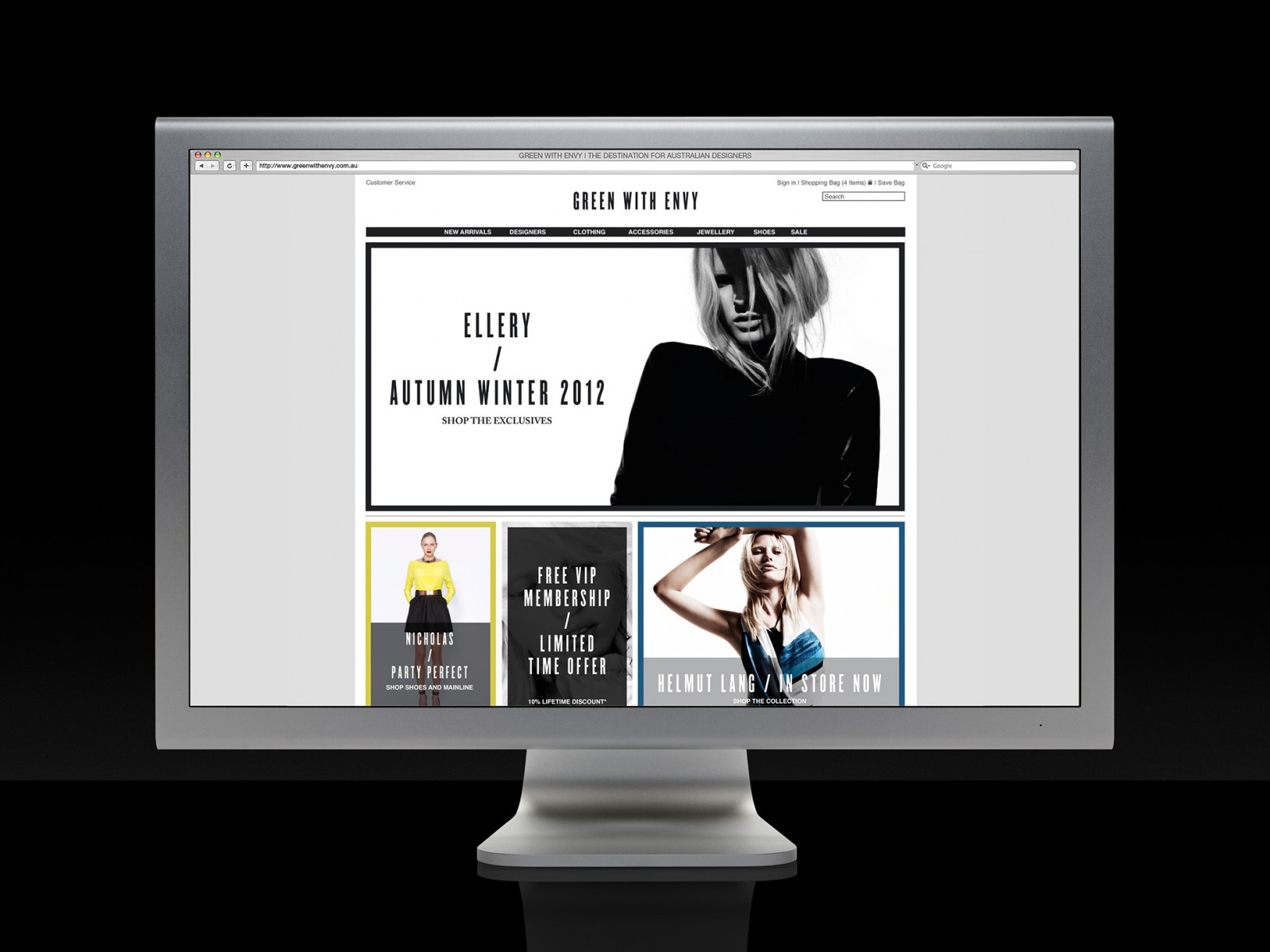

E-commerce

3. The e-commerce giant: Despite the rise of the profligate retail stores, we can’t escape the fact that e-commerce targets the next generation of luxury buyers. Right now, a staggering 40 per cent of high-end bands do not sell via the web. But that’s just a matter of time. Brands, increasingly, are engaging younger buyers through social media-video blogs, animation, and great online offers. It won’t be long before they begin selling aggressively online. According to ‘Top 25 Social Global Luxury Brands’, a report by Shareablee Inc., which investigates and analyses market trends in luxury, video technology is a major contributing factor in the growth of awareness about luxury brands. Statistics show that there has been 224 percent growth in video engagement since January 2015. As brands increase their activity on social media and on video-friendly platforms, they are likely to reach more consumers and engage with a wider audience. But instead of putting their entire range of luxury products online, brands are putting out limited products that will appeal to the market they are talking to, through e-commerce and social media platforms. Hermes online boutique, for instance, does not include their highest value pieces – the Birkin and Kelly bags. Instead, consumers are directed to the store, where specifications can be discussed in person.

Piaget Flagship, Mandarian Oriental (Courtesy Piaget)

4. The rise of India: In 2015, the Indian luxury market rose 25% year-on-year, and is forecast to grow by 86% in constant value by 2018. This growth has helped not just global brands-Chanel, for instance, is planning to open its second store in India-but also home-grown brands like Titan watches, Gitanjali Gems and PC Jeweller to make it to the ‘2015 Deloitte Top 100 Luxury Brands’ list as the brands to watch out for. Many global brands, in fact, are offering India-inspired products, among them Moet Hennessey, which is making one of its sparkling wines in a vineyard in Nashik, Hermes, Gucci, and even Jimmy Choo. While India still ranks just outside the top 20 markets in the world for luxury goods, its rapid advance in luxury goods sales is unrelenting. The country is on course to become a US$4 billion industry by 2020, according to luxury consultancy, Bain & Co.

These trends are likely to transform the luxury industry in unrecognizable ways. At LuxuryNext, we will closely track the market to bring you stories on trends, brands and people who will influence and change the course of the luxury industry.